OTCBB Penny Stocks Trading Market Makers L2 Charts Technical Analysis Financials Learning Discipline Networking Planning Bankroll Management Taking Profit Paper Trading Options Nasdaq NYSE Small Cap Stock Picks Alerts Bashers Growth Pennystock Sub Penny List Stop Loss Top Hot

Bitcoin Live is now offering a monthly and quarterly option!

SIGNUP bitcoin.live/?aid=107

Finally a project I can get behind. I am honored to be a founding analyst for Bitcion Live. Why should you join? Watch my webinar here:

https://www.youtube.com/watch?v=fhm3ihm2UD0

PREFACE:

Poll 1 Part A:

This one is fun, who is your favorite MM to hate? As expected most people select VFIN. The trader mentality is very interesting. The simple name VFIN strikes fear into peoples heart, but many do not know other MM's can be just as deadly, especially CDEL. for me CDEL is deadly because he appears to be retail but is often a wolf in sheeps clothing.

CFGN is the new VFIN, so watch out for that guy....

Poll 1 Part B:

I threw in CSTI as a decoy, as CSTI is not an MM to fear. VERT is a badass and will play AX, and is usually found in tickers over a penny, but also occasionally down in the subs.

CFGN is the new VFIN, complete buzz kill. As of right now, many traders do not know this is a Mal MM, so they are trading blind.

VNDM is interesting, I almost always assume VNDM is retail, but my guess is VNDM is 50% retail and 50% Mal. Your only cue is the block size

Poll 2:

I just want to know who answered "14c"! Those are usually the kiss of death (think AS increase, RS).

The audience got this one right in my opinion. The most explosive filing is an 8k, this can be a merger, debt pay-off, acquisition, pretty much anything. The reason why its so good is that it is a legit filing, a material event, and can not have misleading or false information. Press releases can be full of BS fluff, but an 8k is meat and potatoes

Poll 3:

July 4th -- I will admit that I fell into the all of the above category

Poll 4:

It turns out this is false, this is just a line used by pumpers. They know that if you have your sell orders really high, you would be clogging the ask and they themselves can sell into buying pressure, and when it dries up you will be stuck holding the bag.

For me, my favorite price range is the .0020 to .0030. The reason why I like it is that the play has usually fallen very far down, and at this point is beginning to stabilize. If things go wrong, you have enough space to bail before it gets to trips. If you start out on a play at .0010, its very easy to get trapped and each tick down from that point represents a significant loss.

In general, I almost never play a ticker less than .0010, but there are for sure exceptions.

This one was fun to do. Every has their own idea of the "biggest scam on OTC', or "biggest POS of all time". For me it has to be MTVX since I lost 6 figures there, but having been a casual observer of both VPCO and TBEV, they are pretty big "turds" as well, to borrow a common term.

I know I am leaving out many many plays here. Feel free to let me know which ones I am forgetting!

Which of these is the greatest sin in terms of trading malpractice? Very hard question to answer. I think it really depends on your trading style. I know some very very solid traders who do not use L2 at all and focus on the macro setup, and I know some very very solid traders who swear by L2 and can read all the subtle cues that are given.

For me personally? I think it has to be a combination of L2 and chart. Often my mistakes come when I buy no where near a 52W low, and am too fast to enter and do not have a good sense of L2, which MM is the ax and the structure of the trading channel.

For #cryptocurrency a big mistake people often make is to buy without looking at the chart. They have a conversation with a friend about how good the technology is and all the upside, but neglect to study the "position in channel" and blindly buy. If you really believe in a coin you should want to acquire as much as possible, and that means getting in at a good spot on the chart. How to do that? Read the newbie guide http://chedstrading.blogspot.com/2018/02/the-complete-beginners-guide-to-crypto.html

Fun one to do. The other 3 traders on this list I respect a lot, and look up to. FPS and RSP have very legit premium services, and I feel that they are my elders, teachers and I am tbh not on their level yet. Beard has his premium chat and is lightyears beyond me in his ability to read L2 among other talents.

Poll 9:

Having been in many many chatrooms, learning about all types of hustlers up and down the food chain, for me personally I have found that it works best to keep a tight tight circle of trusted and talented traders around you. Trust is built up over time, and its important to remember people are greedy and selfish in human nature, so be cautious when you are dealing with them.

That being said, there are some great teachers out there that you can trust, and I try to be one myself to newer traders who are starting out.

Poll 10:

I think this is a question almost all traders who use TA think about, especially the new ones starting out. The real answer is that it boils down to size. From my own experience, big board plays lend themselves better to weekly analysis, to understand the trend. If you are day trading and trying to get in and own the same day, you are probably looking at a 5 or 15 minute chart.

For me personally, I tend to use the daily chart, and then 30 minute chart, but I will admit I am still experimenting. A lot depends on how much volume the ticker has. The more volume and greater number of trades the better, that way you can get a better statistical analysis.

Way too many people in #Cryptocurrency are using 1 and 5 minute charts and getting in a lot of trouble. In my experience you should never use less than a 15 minute chart and the reason why is that you will get "whiplash" - You will put too much emphasis on signals and patterns only to found out later there is a larger pattern and trend line in play from a 1 or 4 hour chart. I talk about this in the newbie guide to crypto - http://chedstrading.blogspot.com/2018/02/the-complete-beginners-guide-to-crypto.html

Prop bids happen all the time, you just dont know if they are "prop" or not until they get hit. Whats a prop bid? Its when someone puts up a large lot, say 10M on bid to discourage people from selling. They are trying to get you to slap the ask and buy their shares. You can tell its a prop, or fake bid when it gets hit and that bid suddenly disappears

Loading walls are very very common. A loading wall is a large block put up on the ask to encourage you to sell, and force the price to stay in a specific channel. For example, someone may have a large bid they want filled at 23, so they put up a loading wall at 28 which will scare other retail into selling at 27,26,25, 24 etc.

Bid whacks? Im referring to small lots, maybe only 100 shares, sometimes more into the bid to manipulate the price and make it look like there is more selling than there actually is. Most of the time this is done by someone trying to bring the price down to accumulate, or by a note holder or shorter trying to drive the price down. Note holders make more money when the price goes down before they convert because in their terms there is often a "lookback period" which takes the average price over a 5 or so day period, calculating how many shares they get.

AON orders? IMO, this is not un-ethical at all, just a smart way to load.

In #cryptocurrency we see this a lot - Large sell walls to convince you to sell, and large bid walls to convince you to buy. The challenge is not knowing if that wall is "real" or not and can be pulled at any moment.

Here is an example of a sell wall:

Here is an example of a buy wall:

Its hard to argue when people say trading is an addiction. I know that in those first few moments in the morning when the market opens (especially monday) I get a huge rush, watching all the tickers moving up and down. It all seems so amazing and exciting to me those first few minutes, and it really gets me going for the day.

As the trading week winds down around 230pm on Friday, I can already start to feel a slow sadness coming on, knowing that action will be closed for the weekend (not even holiday ones, those are another story!) Its good to have some separation, and the weekdend is a great time to brush up on your skills, and in my case also work on #chedsblog.

For those of us who are #cryptocurrency traders, there are no days off, and often no sleep -

Poll 13:

This is a very interesting question to me: There is clearly a different class of trader between someone who sits and home with multiple screens vs some guy trading on his phone. Each type of platform both suits the personality of the trader but also the current dynamic they are in. So the biggest question is, does it correlate that desktop users are both better traders and make more money than I-Phone users?

My guess is there is some partial overlap, but perhaps not determinative. The most obvious reason why so many trade from their mobile phones is that they have full time day jobs. Most of them probably make between -$10,000.00 and +$10,000.00 a year, and its a hobby. However, there are some reason and very profitable traders who trade by their phone by choice, and im sure they all have their reasons. I can imagine if you are so profitable that can you afford to play from your phone, you may want to have it handy as you are sipping margaritas at Cancun, bidding and slapping from your Iphone.

In conclusion, I would venture to say most serious and profitable trader do use a desktop and have multiple screens, but that does not mean doing so will make you a profitable trader. Cheers

PS. I trade from an IPAD :)

There are lots of ways to trade #cryptocurrency - I primarily trade from a desktop but also trade mobile as well, and when I am I use tradingview for charting, and the binance mobile app -

When I put out this poll, I thought that "neither" would get 0%, since its a throw away answer, and obviously wrong. 'Shareholders" is the answer I expect to hear the most from new and inexperienced traders, who believe that the CEO has their best interest in mind and can't wait for news. The dirty OTC secret is that the CEO is only releasing this news for the NOTE HOLDERS. PR's are for note holders because the goal is to build up excitement and retail interest, so the note holder can sell and recoup their loan to the company. Very basic stuff.

I can see an argument being bade for "Both", but the technically correct answer is Note Holders.

Share buy back is very powerful catalyst, and very very rare. This is often a sign that the company has extra money and is less likely in the near future to take our more toxic debt. Personally for me, I like the "Toxic Note ending", such as we are seeing with $ASCK right now. On these types of plays, when this note ends there is a window with no dilution and all the retail pressure shoots the price right up. Very classic setup

RM annoucement is 50/50, in my experience when you see an RM announcement, the shell being RM'd into has a lot of toxic debt and needs to be chewed through, and this limits the run.

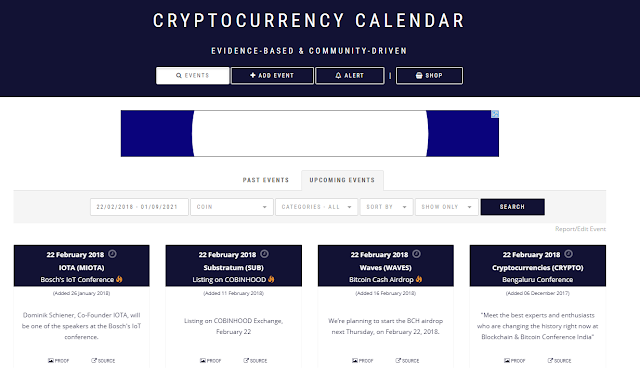

For #cryptocurrency sometimes there is a random pump that will move a stock, but in the end actually hurts it -

And sometimes there is a news driven even - You can check out news and upcoming catalysts at https://coinmarketcal.com/

I tweet during the day when I see interesting things, tickers moving or big sell offs and possible bottom feeder entries, but unfortunately I do not have enough funds to play all the tickers I see.

This is a tough one -- these are all very clear sell signals. Recently CDII had ANOTHER 13g, basically telling everyone that the note holders re loaded with shares and will be dumping them into the market. A 14C is a clear sell signal, but not as strong as the others I think. Occasionally a 14C for an AS increase will come out and either the AS increase is not that much or traders have already priced it in. However, a 14C RS filing is an immediate sell.

"Prop bids getting smoked' What does this mean? Well, often on these tickers you will see normal bids 100-500k, then there is a 10million bid there and trader see it as a sign of confidence. These bids generally speaking are not ones that the buyer intends to be filled, they intend to put it up there and push the price up rather than have it filled, so when you see it getting hit, that may be a key to sell, albeit a subtle one.

Certain pumpers on the board? This is a very key one for certain people, as it generally is a bad sign when known pumpers or those associated with short groups show up. Knowing who is who in the game is very important for making a wise decision.

Correct answer: C. You must know A before you can verify B, achieve C

Once you have learned enough about filings, about L2, about the ebb and flow of price action then you can start to network and make friends -- Find traders you trust and ones you can learn from.

Its October now and MJ stocks are heating up again -- We have many states with recreational on the ballot and if those pass there will be a nice catalyst for the industry. Right now we are in the middle of a slight pullback after some huge run ups in late September and early October -- As we speak, MJ is king and there is a lot of $flow going into these plays. We are seeing previously dormant companies put on PR's now, often very weak but still good enough to catch that retail interest and get things moving.

With #cyrptocurrency there is also a cyclical nature, every year we see a dip in January/February.

This might be one of those questions where there are more than one correct answer. I think "Always Take Profit" is for sure a correct answer, but one could argue that "Liquidity is King" is more important. If there is not enough liquidity in a play, good luck taking profit, no one can buy your shares :)

This poll sparked a great discussion, which can be found on this thread: https://twitter.com/BigCheds/status/805162012565241856

What surprises me is that so many people answered A, $9.95 This is a lot of money to pay and is really cutting into your profitability. I would suggest switching brokers or calling up your broker and demanding a lower fee -- As our friend @crtaylor81 reminds us:

With #cryptocurrency there are lots of different prices on each server for how much you pay in fees - Here are a few tips

If you trade on GDAX and use limit orders, there are zero fees.

If you trade on Binance and use the BnB coin, you get 50% off fees.

https://steemit.com/crypto/@therealwolf/bnb-and-binance-explained

This is a very important topic to consider -- and links in well with another #chedsblog article:

What is a good opening position size?

I think the correct answer should take into account both the size of your trading bankroll as well as the average daily volume.

Generally speaking, my opening positions are $750-$1200

The time you spend on the weekend is extremely important for improving your game - This is a critical opportunity for you to look back and reflect on your trading week. What were some of the mistakes you made, what were some good plays you made?

The weekend is a great time to sharpen your TA (technical analysis) skills. There are some great videos on you-tube you can watch and learn, they have been quite useful to me: https://www.youtube.com/user/StockGoodiesTASchool

Results:

The largest group voted 2-6 hours, which is a pretty wide range. I think if you are going 5+ hours that is just about enough, but in reality the more work you but in the more it will pay off down the road.

Generally speaking trading is like poker, so you want to work harder than your opponents. If other traders are working 6 hours on the weekend, I work 12.

https://twitter.com/BigCheds/status/881556228568231938

"Every weekend I consider not doing chart research (even with a short monday) is a weekend I consider making less money or even losing money."

For #cryptocurrency this is no different. You need to put in the time to study and get better, and I recommend you start here with the newbie guide - http://chedstrading.blogspot.com/2018/02/the-complete-beginners-guide-to-crypto.html

https://www.investopedia.com/ask/answers/05/logvslinear.asp

For OTC I always use log scale, just seems to work better for me - Cheds

Poll 25:

It is extremely important to check the share structure or total coin structure before you enter a play -

For OTC - https://www.otcmarkets.com/

Type in a ticker name, and then go to "security details" -

For #cryptocurrency go to https://coinmarketcap.com/

Type in a coin or token name and the information pops up -

Why is this important?

https://www.investopedia.com/articles/basics/03/030703.asp

Poll 26:

In #cryptocurrency there is the concept of 'FUD' -

FUD - Fear, uncertainty and doubt. Often associated with a campaign to disparage or talk down a certain coin to perhaps drive the price lower by affecting morale. Someone might say, "Ignore the FUD, just HODL"

Another thing that kills a coin/stock is too much pumping, or over-hyping. This did a lot of damage recently to both $TRX and $XVG, where the price was driven up high too fast and the company failed to deliver.

With the OTC there is the concept of "Toxic Debt", where more and more share swill be added to the active float, essentially diluting the value of any shares you currently hold. The same concept is true for #cryptocurrency - Based on how many coins there are in open circulation that determines the market capitalization, and when more coins are released it drives value down.

Paper Trading - Paper trading (sometimes also called "virtual stocktrading") is a simulated trading process in which would-be investors can 'practice' investing without committing real money. ... Stock market games are often used for educational purposes.

Paper trading is a great way to start out and practice without risking your own money. I recommend all new traders try it.

Poll 30:

An alert is when someone tells you to buy, right away and may or may not even give you a rationale.

A setup is when someone presents to you a possible setup when it might be a good idea to buy if certain conditions are met.

Alerts are synonymous with pumps and dumps:

Here is an example of a setup -

You can see above I lay out some possible good conditions for entry and explain why. - Here is another example

Poll 31:

If you are someone who just likes to HODL and believes in Fundamental Analysis, you probably do not spend much time studying the chart. Your plan is to buy now, hold a few years and be rich, so who cares about the entry?

I do! I would argue that the entry is always important. If you are say, a believer in $ADA, you could have bought at 6000 satoshis and happily held for a year perhaps - However, you could have just bought this last week around 3000 satoshis and had almost double the number of coins/tokens!

Thats why the chart is always important, and you should always target an oversold entry on the 4 hour or daily chart. Let me show you here-

Poll 32:

I like to check in with my people as much as I can to get good feedback. My goal is to help as many people as I can in the most effective way and this helps me do that.

Poll 33:

There have been a lot of rumors surrounding $XRP getting listed on Coinbase - https://www.oracletimes.com/huge-rumor-monero-xmr-and-ripple-xrp-headed-to-coinbase-soon/ One potential problem for $XRP is that when it was at $3.00 it was arguably very over-priced, so would coinbase have something on there that would trade between $1-$5? Maybe

Another one that is often talked about and I agree with is $ZRX. Firstly because it is one of the most legit non major coins, with other alt-coins already building off their protocol, and has the backing of some of the best VC investors in silicon valley. Lastly, one of the Coinbase Co-Founders is on the $ZRX board -

Poll 34:

So, first results were very encouraging. I did this poll again exactly one month later, and here are the results. Interesting to see the shift.

This tells me that people have had a tough month! With bitcoin having a big drop and now stabilizing, Alt-coins also have taken a blood-bath. I think many of these folks bought coins like $ADA $XRP $XLM near the top thinking they were safe and have been holding all the way down.

Poll 35:

Binance is by far the most popular as you can see - For more info check out the newbie guide - http://chedstrading.blogspot.com/2018/02/the-complete-beginners-guide-to-crypto.html

Poll 36:

Oh boy - This must plague all of us. It is incredibly hard to avoid checking your crypto wallet - Sometimes in the middle of the night when I get up to go to the bathroom I am tempted to check, but if I do there is no chance of falling back asleep ...

Poll 37:

There are lots of ways to look at a chart, and in general you should always start with the larger time frames (daily/4 hour) then work your way down and view the smaller frames (1 hour/15min) within the context of the larger trend.

Here is an excerpt from the newbie guide -

"What is the best time frame to use? Well, this is a very difficult question to answer so simply. As a general principal, you want to start with a wider time frame and work your way down. If you are a day trader, typically you want to be using a 4 hour and 1 hour chart, and then when there is heavy volume look even closer with a 15 minute chart. In my experience some of the biggest mistakes I have made came when I was trying to use a 5 min chart and look for trend lines and patterns. It is very easy to get fooled with a 5 or even 15/30 min chart with a trend line or pattern, only to be crushed by the larger trend (4 hour or daily)"

Poll 38:

Mistake #1 is addressed in an another article on the blog - "Break the habit! Stop averaging down on that POS, and other trading mistakes"

http://chedstrading.blogspot.com/2015/11/poor-habit-to-break-1-stop-averaging.html

Mistake #2 happens to the best of us. It's easy to think that just because your stock/coin is rising it will keep going, but remember you need to take profit and protect your capital.

#3 This mistake is also addressed by another article on my blog -

"What is a good opening position size?"

http://chedstrading.blogspot.com/2015/11/what-is-good-opening-position-size.html

Poll 39:

I get so many questions on twitter and many of them are just repeats of questions previously asked and answered. The only way to keep my sanity and continue to help people was to create this guide. I hope you take the time to read it and it helps you make money!

Poll 40:

#chedsblog has been a very fun project. The real secret behind this is I wanted/want to prove to myself I can become a strong and consistent trader, and part of that is being able to teach. With any new task the real measure of knowledge is the ability to teach it to someone else. #chedsblog is my record of that journey.

Poll 41:

I have never been a fan of alerts, weather they be text, email or twitter. The best plays I find are the ones that take a while to set up, and you have plenty of time to DD it and decide if you like it before you jump in. Too often traders fall in the trap or wanting to be fed a ticker, and just buy it without doing any research. Thats not what my whisper list is for. I try to send out a message once or twice a month, once I find a play I like enough that I can stand behind and recommend to my fellow traders with some confidence. I am looking for low float, low debt, tickers near 52W low with good chart setup and future catalysts. Clean setups.

I was very pleased to learn that of those who were on my whisper list, they have made money overall.

PS. Anyone who is not on my whisper list and wants to be, find me on twitter @bigcheds

******* UPDATE ********

I am no longer doing the whisper list and have decided to concentrate all energy on my twitter feed so I can reach and help the maximum number of people.

As I do more polls I will add to the post. If you guys have an good ideas for polls I should do, just let me know!

Thanks

CHEDS

Welcome to Chedsblog!

-Helping new traders avoid my old mistakes-

OTCBB Pennystock trading article topics include:

Reading financials and filings

Market makers

L2 and chart analysis

Understanding the competition

Using social media to trade

Price and volume study

Bankroll management

Game theory

Sub .01 low float setups

Interviews with influence makers

This comment has been removed by the author.

ReplyDeleteBagi semua pecinta poker yang bosan selalu kalah, kini Senyumqq.ga menyediakan bukti nyata winrate 85% minimal depo dan wd hanya 15rb :) ^_^ #agenpokerterbaik #bandarpokeronline #bandarpokerterpercaya #agenpoker #poker #domino #ceme #bandarceme

ReplyDeleteinformative post!!

ReplyDeleteTo start your trade in forex trading immediately check here >>

Forex Market News

Online Forex Sell

Profit in Forex Markets